Global Economy in 2025: Stabilization Amid Uncertainty

May 13, 2025 | Global Desk

The global economy is entering a cautious phase of stabilization in 2025, as central banks, industries, and governments worldwide navigate the aftermath of pandemic-era disruptions, inflation surges, and ongoing geopolitical tensions.

According to recent assessments by international financial institutions, global GDP growth is expected to hover around 3% this year, reflecting modest expansion compared to the volatility of recent years. While inflation has cooled in many advanced economies, core prices—especially in housing, energy, and services—remain above pre-pandemic levels, prompting central banks to keep interest rates elevated.

“The world is no longer in crisis mode, but we are not yet in a safe zone,” said Dr. Elena Alvarez, senior economist at the World Economic Forum. “Growth is slower but more consistent, and that’s a positive sign. However, uncertainty remains high.”

Emerging Economies Drive Global Growth

Asia continues to be a major engine of economic activity. India and Southeast Asian countries are experiencing strong domestic demand and increasing foreign investment, particularly in manufacturing and digital sectors. China, however, faces challenges in its real estate sector and declining exports, though state-backed stimulus efforts are supporting consumer spending.

In contrast, many African and Latin American nations remain burdened by sovereign debt, inflationary pressure, and currency devaluation. The IMF has issued renewed calls for global cooperation to support debt restructuring and investment in sustainable development.

Supply Chains and Trade Realignments

Global trade flows are undergoing significant restructuring. The ongoing fragmentation of U.S.-China economic ties has fueled a broader trend of “friend-shoring,” as companies seek to move production closer to politically stable allies. This has led to increased industrial investment in countries like Mexico, Vietnam, and India.

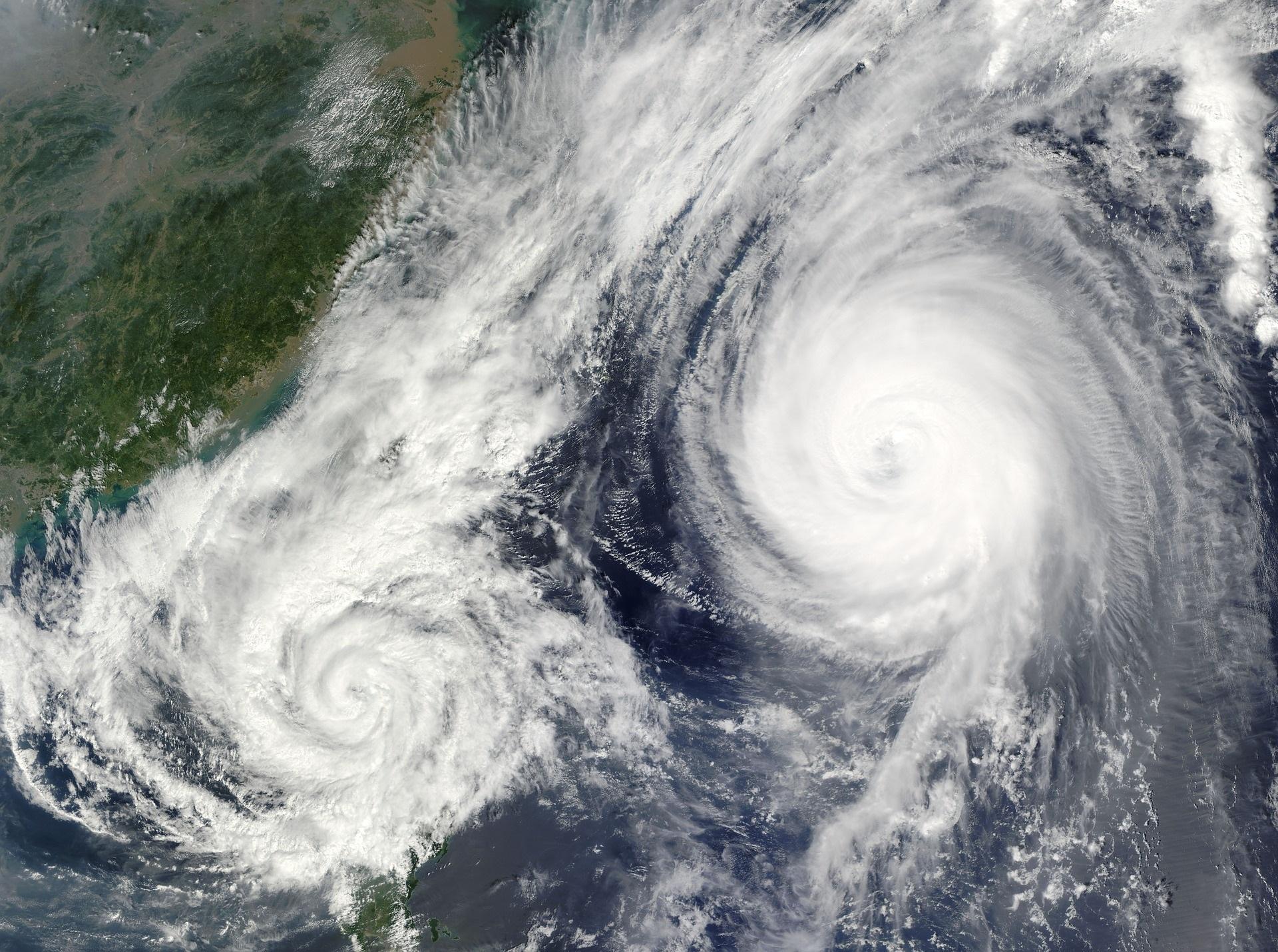

However, logistical issues persist. Port congestion in Europe and Asia, labor shortages, and climate-related disruptions have continued to slow delivery timelines and raise costs across industries.

Climate and Technology as Economic Drivers

Climate change remains a pressing economic concern. Extreme weather events in early 2025—including floods in Southeast Asia and drought in North Africa—have affected agriculture, energy output, and migration. Governments are under pressure to adapt infrastructure and support green initiatives.

At the same time, artificial intelligence and automation are transforming global labor markets. While these technologies are boosting productivity and innovation, they are also contributing to a widening digital divide.

“AI is reshaping everything from finance to medicine,” said Akira Yamamoto, a tech policy analyst based in Tokyo. “But it’s also displacing millions of workers, and governments need to act fast to retrain and support those affected.”

A Fragile Balance Ahead

Despite signs of stabilization, global financial markets remain sensitive to geopolitical developments. Tensions in the South China Sea, political instability in parts of Africa, and energy insecurity in Europe continue to weigh on investor confidence.

Experts warn that without coordinated international action on climate, inequality, and debt, today’s modest recovery could prove fragile.

“The world economy is walking a tightrope,” said Alvarez. “This is a moment that calls for strategic cooperation—not competition—if we want sustainable progress.”